|

|

|

|

|

|||

|

|||

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

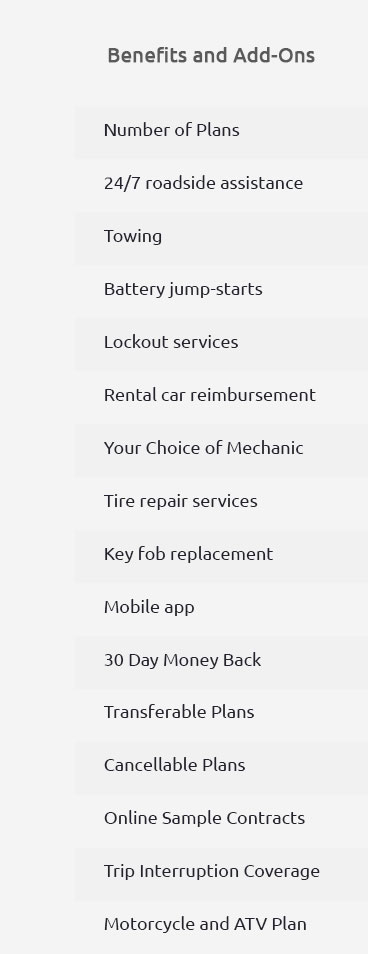

Breakdown Insurance Reviews: A Comprehensive Coverage GuideFor U.S. consumers exploring vehicle protection options, breakdown insurance can be a lifesaver. It offers peace of mind and potential cost savings by covering unexpected repair costs. But how do you choose the right plan? Let's dive into some breakdown insurance reviews to help you make an informed decision. Understanding Breakdown InsuranceBreakdown insurance, also known as extended auto warranties, is designed to cover repair costs after your vehicle's original warranty expires. It's essential to know what these plans typically cover and how they can benefit you. What's Typically Covered?

It's crucial to read the fine print and understand the specific coverage details of each plan. For instance, the mbusa extended warranty cost provides insights into what premium plans might entail. Benefits of Breakdown InsurancePeace of Mind: Knowing that you're protected against unforeseen breakdowns can significantly reduce stress, especially if you frequently drive long distances. Cost SavingsRepair costs can add up quickly. A good breakdown insurance policy can save you from paying out-of-pocket for expensive repairs. ConvenienceWith coverage that includes roadside assistance, you can enjoy your travels without worrying about potential mishaps. Choosing the Right Plan

Some consumers might prefer options like the premier lifetime powertrain warranty, which offers lifetime coverage for critical components. FAQWhat is breakdown insurance?Breakdown insurance, or an extended warranty, covers repair costs for your vehicle after the manufacturer's warranty expires, providing coverage for various components and services. How does breakdown insurance differ from car insurance?While car insurance covers damages from accidents, theft, or natural disasters, breakdown insurance specifically covers mechanical failures and repair costs. Can I get breakdown insurance for an older car?Yes, many providers offer plans for older vehicles, although coverage may vary based on the car's age and condition. https://www.reviews.io/company-reviews/store/www.motorbreakdownrecovery.com

I do not recommend this company at all. As I had phoned in August, but not made a claim, my cover is no longer valid. However, they didn't tell me this. I am ... https://g80.bimmerpost.com/forums/showthread.php?t=2035835

It's very cheap compared to any extended warranties that you can buy. The price ($15 month for new M car) is impossible to beat. https://www.bbb.org/us/mo/lees-summit/profile/auto-warranty-plans/mechanical-breakdown-protection-0714-86090010/customer-reviews

This business was extremely disappointing. They do not function like other insurance companies. The GAP coverage only paid out 3% of the car's value, they were ...

|